Let’s review mortgage rates, inflation and the pending recession.

First off, we can still obtain Prime – 1% (variable) & 5.29% (fixed) for purchases and mortgage renewals, but conditions can apply. Call me for more details.

It has been quite the year in real estate. We went from the hottest market in the past 5 years in January and February to one of the biggest slowdowns since the financial crisis of 2008, all in a span of a few short months.

With yet another Bank of Canada (BoC) meeting resulting in an increase (this time of “only” 50 basis points), we have had a lot of inquiries:

• What’s happening?

• Why is it happening?

• What’s going to happen?

• Options for what’s happening.

Addressing these questions, and more!

WHAT’S HAPPENING?

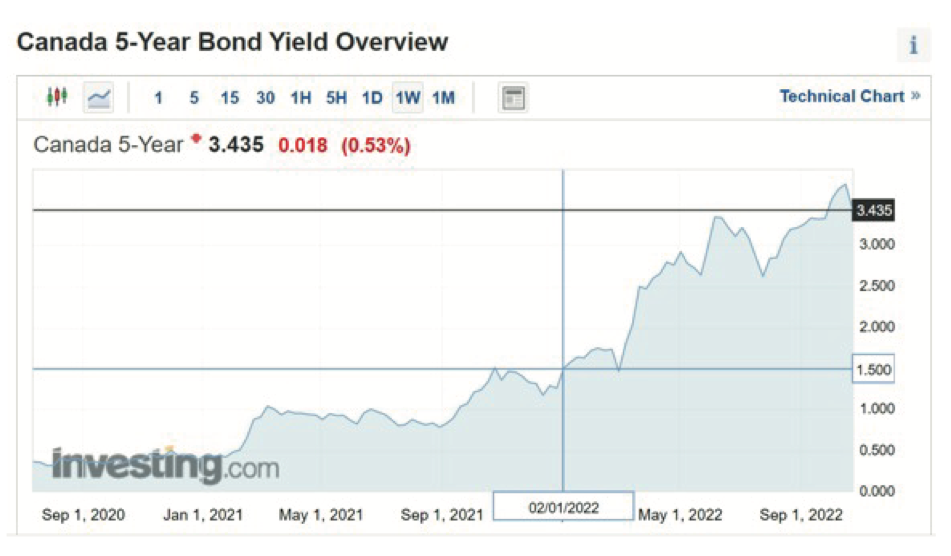

We have seen interest rates this year hike up significantly from their lows during COVID. In spring of 2021, rates as low as 1.69% for 5 year fixed mortgages were still available and variable rates of Prime (2.45% at the time) minus a discount of 1% or even better resulted in many borrowers having rates below 1.5%. But as the saying goes, all good things must come to an end – we just didn’t expect it to be so abrupt. Bond markets, which impact fixed rate mortgages, have shot up from 1.5% to about 3.5%, and fixed rates have risen from about 2.99% to 5.79% in that same period.

What is interesting is that not only have the bond markets gone up, but so have the spreads over top of bonds that banks use to price mortgages. Typically the spread over a bond yield to determine a mortgage rate is about 1.5% – 1.8%, but currently the spreads are closer to 1.8% – 2.2%.

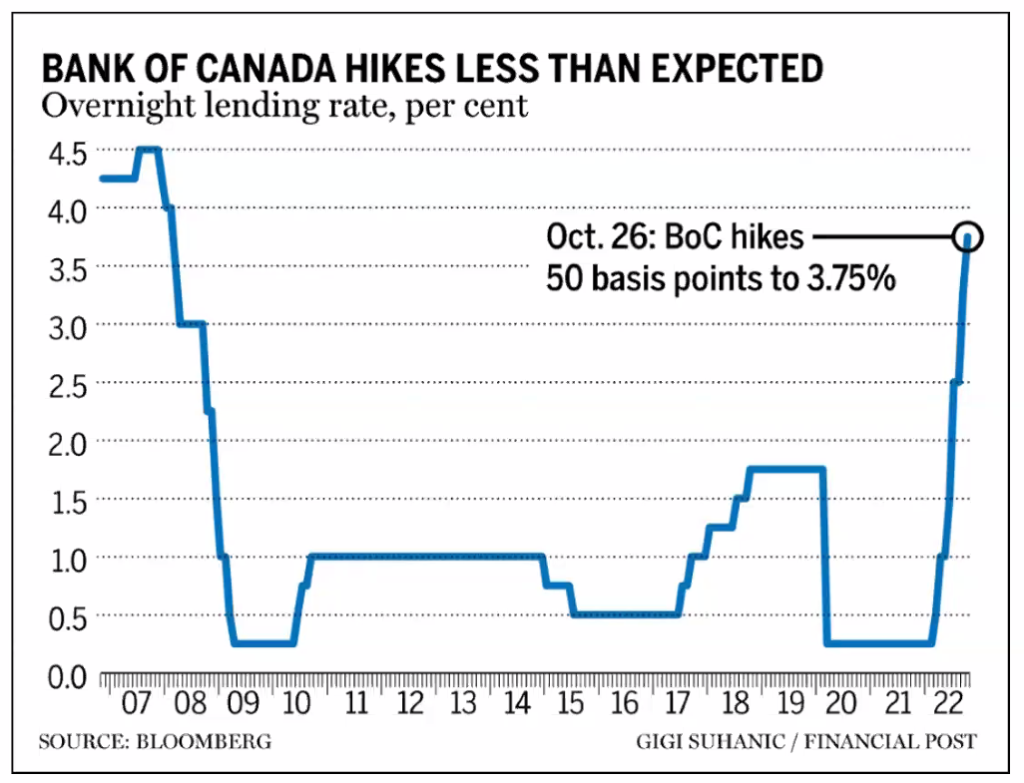

At the same time that the bond markets (and therefore fixed rates) have increased, so too have the variable rates. The Bank of Canada typically meets every 6 weeks or so to determine if they will move the overnight lending rate, which is what the banks all base their prime rates upon. Any movement here impacts all variable rate loans including mortgages, lines of credit, etc. We have seen these rates move up for the first time since 2018, and not just in .25% increments like we are accustomed to. These movements have been in leaps and bounds of .5%, .75% and even 1% at a time. The most recent move of .5% compounds on the issue of increasing borrower payments and creating more financial stress than ever before.

With the increases to the overnight lending rate, this puts the prime rate with the banks at 5.95%. With most banks offering discounts of about .3% off of the prime rate, this would net a new variable mortgage at about 3.65%. This is of course a far cry from where rates were in late 2020 and throughout most of 2021 at closer to 1.5%. Unfortunately, it should read 5.65%

The Qualifying Rate

Another issue that has popped up is that the qualifying rate has also moved up significantly. The stress test is either the rate +2% or 5.25%, whichever is higher. For a number of years this rate was consistently at or around 5.25% as rates were below 3.25%. However, now that fixed rates are over 5.5%, the qualifying rate has increased to about 7.5%, eroding borrowing power by about 25% across the board. Coupled with home prices that are higher than they were pre—COVID no, the sky has not yet fallen on values, this is making it harder than ever to qualify for a mortgage.

WHY IS IT HAPPENING?

But seriously, inflation is the #1 driver of these rates skyrocketing. As soon as it was apparent that the government had very little control over runaway inflation, they decided that drastic action would be required to ensure inflation is kept under control. Inflation and it’s must nastier cousin hyper–inflation can wreak havoc among an economy. In the late 1920’s and early 1930’s, Germans would often bring wheelbarrows to work on payday to collect their pay cheques. A lunch would cost more between the time the lunch started and finished. There are of course more recent examples in many African countries as well as the most recent example happening in Venezuela, which caused many Venezuelans to adopt cryptocurrency as a more stable currency option.

When COVID hit, governments not just in Canada but around the world accelerated the printing presses, flooding the marketing with money. The total amount of money in the market increased from $1.82 Trillion in February 2020 to $2.35 Trillion in February 2022, an increase of 29% over just 2 years. This means there is more money chasing the same amount of goods.

With supply chains around the world getting ravaged, it became more expensive and more difficult to move goods around the world. In many cases this meant that some countries decided to move certain imported goods back home as the US did with microchip manufacturing. This process does take quite some time and results in lower efficiency and higher costs for either a period of time, or forever.

Just as rates were starting to take off, the war in Ukraine accelerated things even further. With much of Europe cut off from it’s cheap oil and gas from Russia, and much of the world cut off from major exports from Ukraine like iron, steel, cereals, sunflower and other oil seeds, corn, wheat and potatoes, energy and food prices have soared.

WHAT IS GOING TO HAPPEN?

Mortgage rates will likely remain steady or slowly declining into 2023. The bond market outlook is about 1% higher than previous, all of whom are predicting that fixed rates will be approximately the same at the end of the year as we are today. For the Bank of Canada, the target seems to be at a prime rate of around 6.2%–6.45%, so a .25%–5% higher than we are today.

Based on this we can see that the markets are assuming we are at or near the top end for fixed-rate mortgages (and yes, many thought this was the case 1% ago in May, too) and that there is another .25% to .5% to go for variable rates. Another interesting observation is that we now see that about half of the lenders are expecting rates to decrease by the end of 2023. The harder and faster the Bank of Canada goes up, the more likely they are to put the country into a recession. In a recession, one of the commonly used levers is to lower rates which is exactly what they did when COVID hit.

WHAT ARE MY OPTIONS?

As of today, I would strongly consider taking a 1 or 2-year fixed mortgage term or a 5-year variable mortgage. Yes, I said that, variable. When (not if) the recession comes, they will be forced to lower interest rates to boost the economy and escape recession. Those taking 5-year fixed rates will very likely be kicking themselves in 12 to 18 months.

Special thanks to Kyle Green for helping me put this newsletter together. Kyle is a very close friend and also the co-author of our book. We are in partnership with all my mortgage clients.

Facebook Comments